عاجل

عاجل| الاتحاد الأوروبي: سنفرض عقوبات على مرتكبي الجرائم في السودان

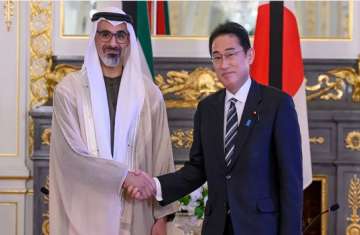

وزير التجارة الإماراتي: مفاوضات الشراكة الاقتصادية مع اليابان وأوروبا في مراحل متقدمة

وزير التجارة الإماراتي: مفاوضات الشراكة الاقتصادية مع اليابان وأوروبا في مراحل متقدمة

"موانئ أبوظبي" تستحوذ على حصة الشركة السعودية المصرية للاستثمار في "الإسكندرية لتداول الحاويات"

"موانئ أبوظبي" تستحوذ على حصة الشركة السعودية المصرية للاستثمار في "الإسكندرية لتداول الحاويات"

الرئيس الكوري الجنوبي يزور مصر لأول مرة لتعزيز التعاون الاقتصادي والثقافي

الرئيس الكوري الجنوبي يزور مصر لأول مرة لتعزيز التعاون الاقتصادي والثقافي

وزيرة التضامن: نخطط لتكون العاصمة الجديدة أول مدينة "صديقة للأطفال" في مصر

وزيرة التضامن: نخطط لتكون العاصمة الجديدة أول مدينة "صديقة للأطفال" في مصر

عمر وعبدالله أيضا

عمر وعبدالله أيضا

الكرملين يرد على أنباء نشر أسلحة نووية في أوروبا لمواجهة روسيا

الكرملين يرد على أنباء نشر أسلحة نووية في أوروبا لمواجهة روسيا

شاهد| تدفق شاحنات المساعدات الإغاثية العاجلة من مصر إلى غزة

شاهد| تدفق شاحنات المساعدات الإغاثية العاجلة من مصر إلى غزة

وزير التجارة الإماراتي: مفاوضات الشراكة الاقتصادية مع اليابان وأوروبا في مراحل متقدمة

وزير التجارة الإماراتي: مفاوضات الشراكة الاقتصادية مع اليابان وأوروبا في مراحل متقدمة

"موانئ أبوظبي" تستحوذ على حصة الشركة السعودية المصرية للاستثمار في "الإسكندرية لتداول الحاويات"

"موانئ أبوظبي" تستحوذ على حصة الشركة السعودية المصرية للاستثمار في "الإسكندرية لتداول الحاويات"

الرئيس الكوري الجنوبي يزور مصر لأول مرة لتعزيز التعاون الاقتصادي والثقافي

الرئيس الكوري الجنوبي يزور مصر لأول مرة لتعزيز التعاون الاقتصادي والثقافي

وزيرة التضامن: نخطط لتكون العاصمة الجديدة أول مدينة "صديقة للأطفال" في مصر

وزيرة التضامن: نخطط لتكون العاصمة الجديدة أول مدينة "صديقة للأطفال" في مصر

عمر وعبدالله أيضا

عمر وعبدالله أيضا

الكرملين يرد على أنباء نشر أسلحة نووية في أوروبا لمواجهة روسيا

الكرملين يرد على أنباء نشر أسلحة نووية في أوروبا لمواجهة روسيا

شاهد| تدفق شاحنات المساعدات الإغاثية العاجلة من مصر إلى غزة

شاهد| تدفق شاحنات المساعدات الإغاثية العاجلة من مصر إلى غزة

التعليقات