Urgent

IGCF 2025 to unveil visions for quality of life

President of Federal Republic of Somalia receives Shakhboot bin Nahyan Al Nahyan

President of Federal Republic of Somalia receives Shakhboot bin Nahyan Al Nahyan

Volcano in Japan spews plume 5,500 metres above crater

Volcano in Japan spews plume 5,500 metres above crater

6.2-magnitude earthquake strikes off eastern Russia

6.2-magnitude earthquake strikes off eastern Russia

Dubai Future Foundation, Amazon launch Gig Economy Programme under ‘Sandbox Dubai’

Dubai Future Foundation, Amazon launch Gig Economy Programme under ‘Sandbox Dubai’

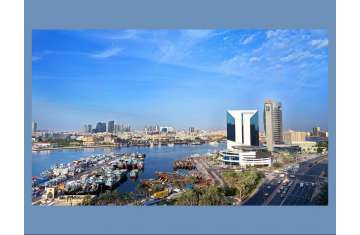

Indian businesses top list of nationalities of new companies joining Dubai Chamber of Commerce in H1

Indian businesses top list of nationalities of new companies joining Dubai Chamber of Commerce in H1

ADNOC signs 15-Year LNG Sales and Purchase Agreement with IndianOil

ADNOC signs 15-Year LNG Sales and Purchase Agreement with IndianOil

UAE marks Emirati Women’s Day tomorrow

UAE marks Emirati Women’s Day tomorrow

President of Federal Republic of Somalia receives Shakhboot bin Nahyan Al Nahyan

President of Federal Republic of Somalia receives Shakhboot bin Nahyan Al Nahyan

Volcano in Japan spews plume 5,500 metres above crater

Volcano in Japan spews plume 5,500 metres above crater

6.2-magnitude earthquake strikes off eastern Russia

6.2-magnitude earthquake strikes off eastern Russia

Dubai Future Foundation, Amazon launch Gig Economy Programme under ‘Sandbox Dubai’

Dubai Future Foundation, Amazon launch Gig Economy Programme under ‘Sandbox Dubai’

Indian businesses top list of nationalities of new companies joining Dubai Chamber of Commerce in H1

Indian businesses top list of nationalities of new companies joining Dubai Chamber of Commerce in H1

ADNOC signs 15-Year LNG Sales and Purchase Agreement with IndianOil

ADNOC signs 15-Year LNG Sales and Purchase Agreement with IndianOil

UAE marks Emirati Women’s Day tomorrow

UAE marks Emirati Women’s Day tomorrow

Comments